Cool Debit Side Of Profit And Loss Account

As the net profit or net loss of a certain accounting period is determined through profit and loss account so its heading is.

Debit side of profit and loss account. A net loss is a Debit in the Profit and loss account. Under International Accounting Standards the profit and loss account is superseded by the Statement of profit or loss and other comprehensive income. It makes no change to Assets or Liabilities.

The following items usually appear on the debit and credit side of a Profit and Loss Account. Items on the Credit side of Profit and Loss Account. Return outward appearing in the trial balance is.

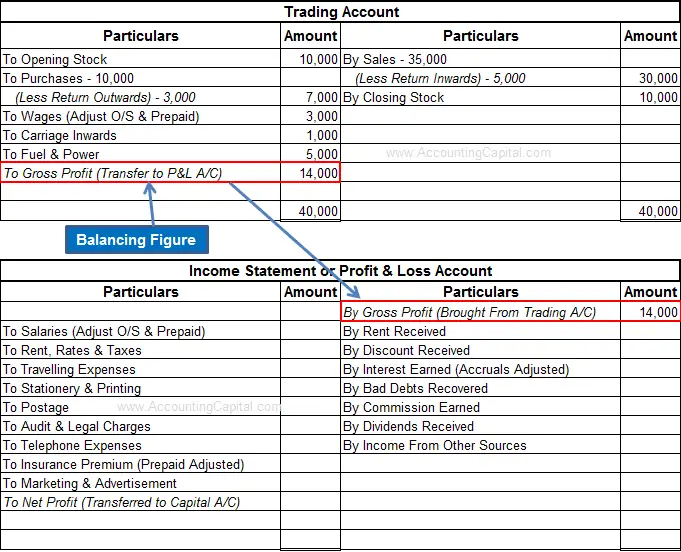

D as addition to capital in balance sheet. Profit Loss account represents the Gross profit as transferred from Trading Account on the credit side of it along with any other income received by the firm like interest Commission etc. Profit and loss account get initiated by entering the gross loss on the debit side or gross profit on the credit side.

A On the debit side of trading account. Debit Balance of PL ac means a loss to the firm. This value is obtained from the balance which is carried down from the Trading account.

Hence -ve balance in Liabilities Side which can be shown on Asset Side. Gross Loss Transferred from Trading Account All Indirect Expenses. Postage Telephone.

Cost of Sales This term refers to the cost of goods sold. Net Profit or Net Loss is the difference between the total revenue of a certain period and the total. If credit side is more than the total of the debit side the difference between the two totals is the net profit.