First Class Why Do You Prepare Trading And Profit And Loss Account

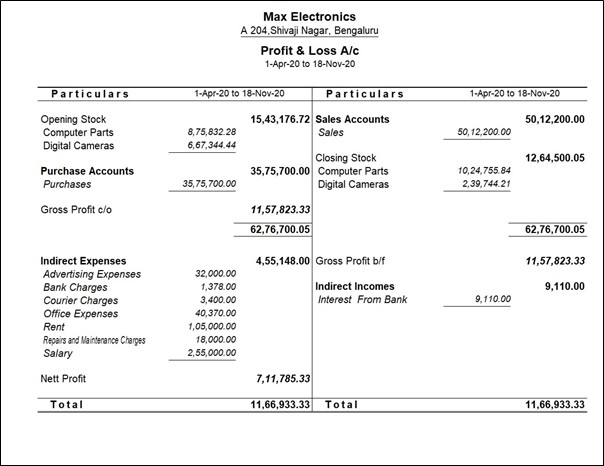

As the name suggests it includes all the trading activities conducted by a business to ascertain the Gross ProfitLoss.

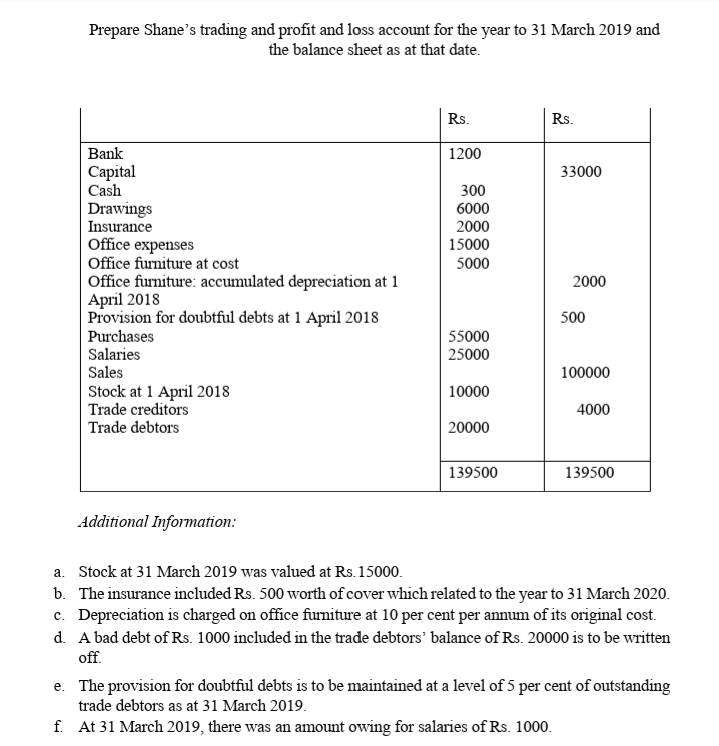

Why do you prepare trading and profit and loss account. Also explained is the preparation of trading profit and loss ac and balance sheet without adjus. The forex website DailyFX found that many forex traders do better than that but new traders still have a tough timing gaining ground in this market. The motive of preparing trading and profit and loss account is to determine the revenue earned or the losses incurred during the accounting period.

Trading account is the first step in the process of preparing the final accounts of a company. Trading Account and Profit and Loss Account and Balance Sheet - An Example. The profit loss account provides information about an enterprises income and expenses which result in net profit or net loss.

Prepare the Trading and Profit and Loss Account for the year ended 31st December 2019. Trading account is a nominal account in nature. Profit Loss Account is part of final accounts prepared by a business firm to know the net profit of the business activities during a particular period.

Why are Profit and Loss Accounts prepared. While preparing the final accounts there may be some items so far not adjusted. Both the trading account and the profit and loss account form part of the double entry as they are used to close off the temporary accounts at the end of an accounting period.

If we make a trial balance after having prepared the Trading and Profit Loss ac we will find only real and personal accounts in it apart from the nominal account Trading and Profit Loss ac. By preparing the Trading Account a business firm can take the decision for continuing or discontinuing a particular product or can do some modification in any product to earn maximum profit or reduce the losses. Profit and Loss Account is different from Trading Account because Trading account shows only the gross profit while profit and loss account shows net earnings of the business firm.

The trading and profit and loss account are two different accounts that are formed within the general ledger. The profit and loss account is the lower part of the trading profit and loss account and is used to determine the net profit of the business. It is prepared to disclose the result of operations of all the business transactions during a given period of time.