Simple Converting Your Balance Sheet To Tax Basis Example

If you purchase a year-long subscription you will include it on your balance sheet and then move over a portion of that expense on a monthly basis.

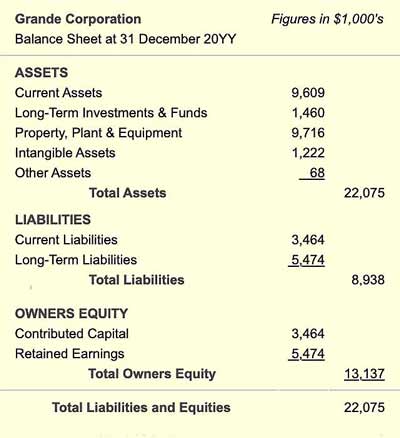

Converting your balance sheet to tax basis example. You should be able to reconcile the tax basis of the To explain the tax basis you can think of the balance sheet at the partnership SPV. Asset accruals and deferrals are items that have been added to the balance sheet to account for non-cash assets. PE Prepaid expenses.

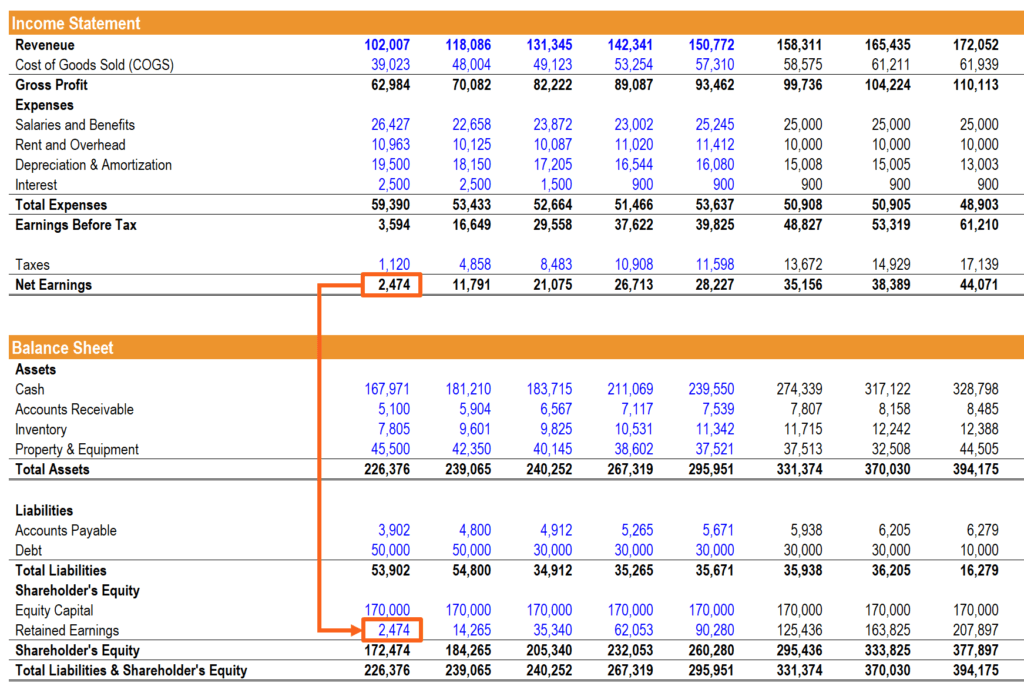

I would make a book to tax M-2 adjustment so you can reconcile beginning to ending retained earnings. Adjust the trial balance to reflect the previous years book-to-tax adjustment. A companys financial statements serve as an information source for filing federal income taxes.

That means that the balance sheet always reflects what the books actually are typically accrual method of account regardless of the basis of accounting for tax purposes. The Modified Outside Basis Method the. There are two items that can affect the outside basis of the tax basis.

Partnerships that did not prepare Schedules K-1 under the tax capital method for 2019 or otherwise maintain tax basis capital accounts in their books and records for example for purposes of reporting negative capital accounts may determine each partners beginning tax basis capital account balance for 2020 using one of the following methods. Determine amounts that may have been owed to your organization as of the last day of the year or month ie. Other Useful Accrual to Cash Conversion Formulas.

Complete the Cash Basis Conversion. This entry can be computed by subtracting the previous years book-basis balance sheet from the previous years. The methodologies noted are.

MI Merchandise inventory. Examples of asset accruals and deferrals include unbilled revenue accrued interest income and deferred tax. The accounts receivable is increasing sales by 300000 and the accounts payable is increasing the expenses by 35000.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)