Looking Good Deferred Tax Asset Journal Entry Australia

C an item of revenue is included in taxable income or t ax.

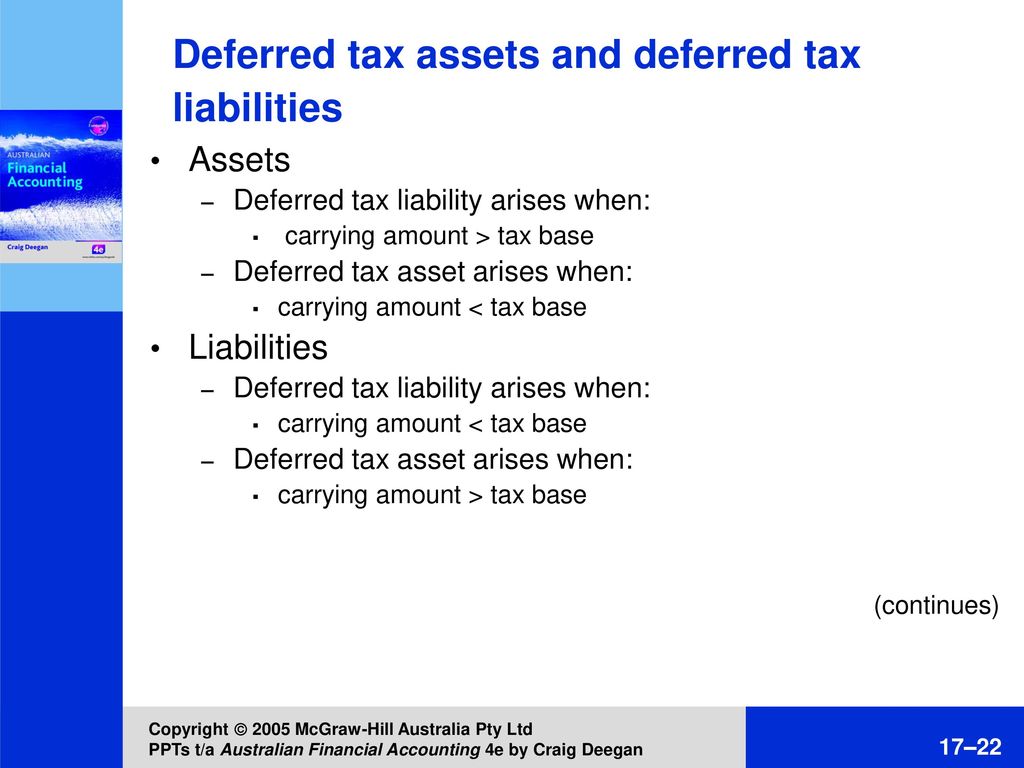

Deferred tax asset journal entry australia. And conversely that an asset in the nature of a future income tax benefit arises whenever. In the report the Australian accounting standard 112 on income taxes has been deeply analyzed with an understanding as to how the accounting treatment is done for the transactions of the company relating to deferred tax asset or the deferred tax liability. Deferred tax asset DTA deferred tax liability DTL Accounting entry.

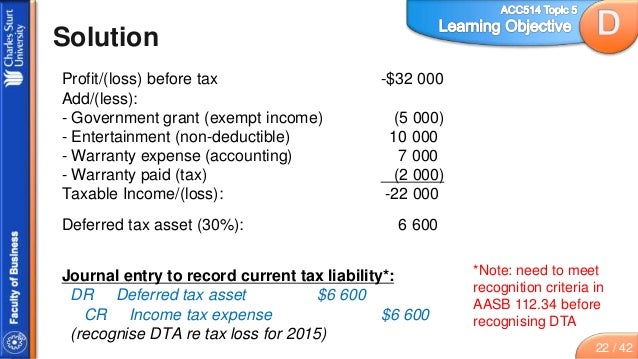

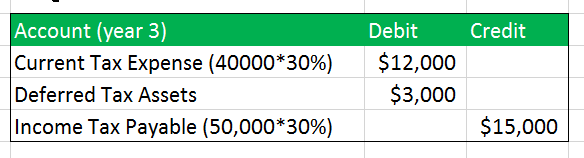

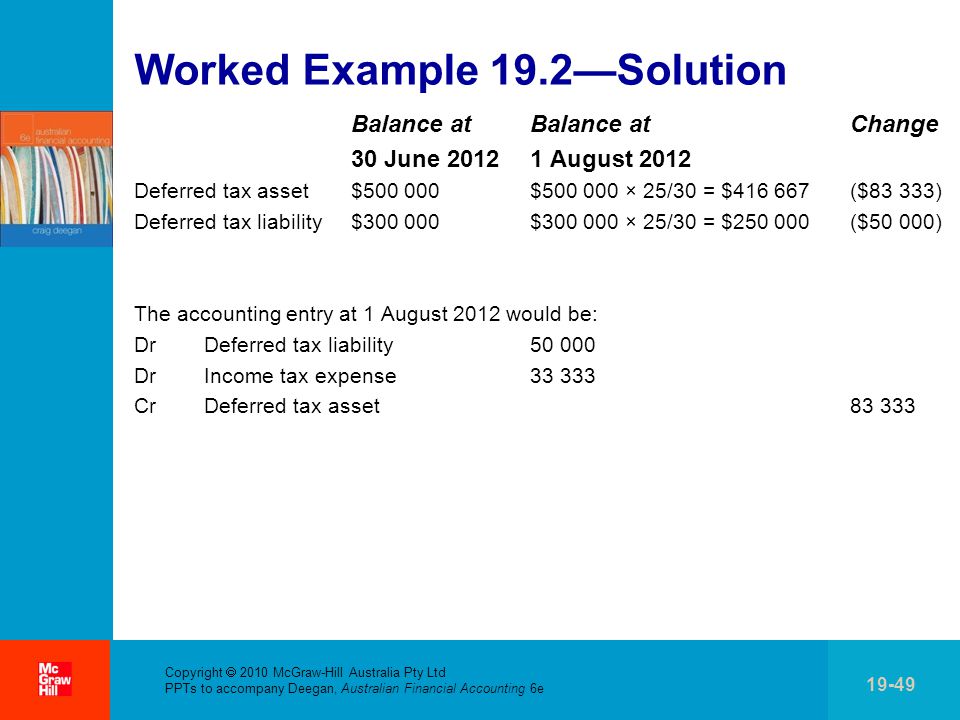

The movement of -70 is accounted for as a reduction in the deferred tax liability with the following journal. Accounting for a deferred tax asset and deferred tax liability tax accounting vs financial book accounting basic understanding of each A Deferred Tax. The temporary timing differences which created the deferred tax liabilities in years 1 and 2 are partially reversed in year 3 as the book depreciation is now higher than the tax depreciation.

330 lacs DTL newly calculated. Under the tax accounting standard AASB 112 Income Taxes to calculate deferred taxes companies must determine whether they expect to recover the asset through sale using. For tax purposes in Australia these indefinite lived intangible assets typically have a capital gains tax base but no amortising tax base.

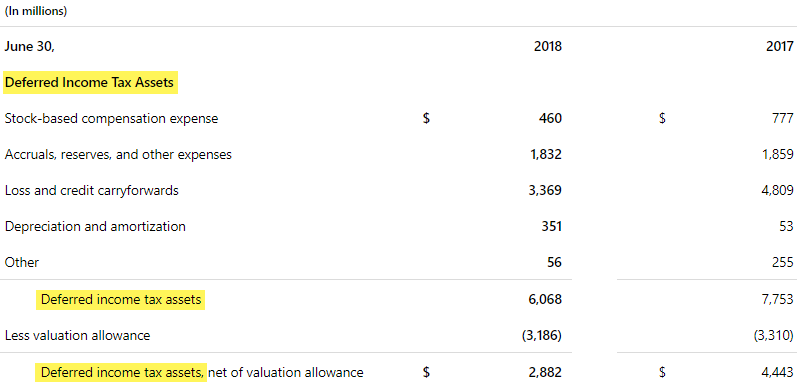

Ts tax rate is 50. Hence deferred tax asset arises when the tax payable is higher than the tax expense incurred by the company. Measurement of deferred tax IAS 12 states that deferred tax assets and liabilities should be measured based on the tax rates that are expected to apply when the asset.

Deferred income tax and future income tax benefit. 15 lacs which arrived at 1170 lacs current year. The only one entry will be passed in books for Rs.

The journal entry for current tax is. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realised or the liability is settled based on tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period IAS 1247. Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked out based on accrual basis or where loss carryforward is available.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)