Neat Deferred Tax Calculation In Excel Free Download

Disallowing Depreciation as per Companies Act Deferred Tax Basics Difference between DTA and DTL Permanent Difference And Timing Differnce Deferred tax computation format You are here Income Tax Computation Format For Companies Amendment.

Deferred tax calculation in excel free download. Download Excel Deferred Tax Rate Calculator Templates. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Download Phpcgi For Osx.

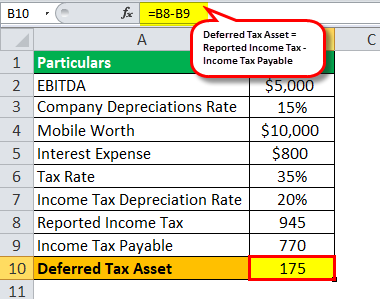

DisclaimerThe above calculator is only to enable public to have a quick and an easy. Here an effort is made to comprise all tax computation viz Provision for Tax MAT Deferred Tax and allowance and disallowance of Depreciation under Companies Act and Income tax Act in one single excel. An excel sheet to better understand the deferred tax calc.

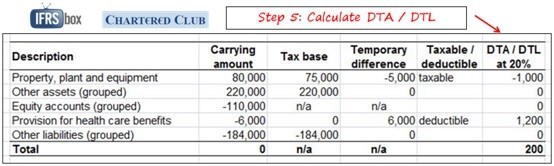

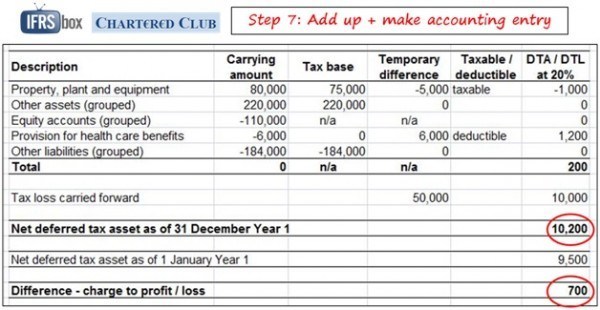

You can calculate your tax liabilities as per old and new tax slab. The former is based on the difference between accounting balance sheet and tax balance sheet while the later is based on accounting profit or loss and tax profit or loss. Information relates to the law prevailing in the year of publication as indicatedViewers are advised to ascertain the correct positionprevailing law before relying upon any document.

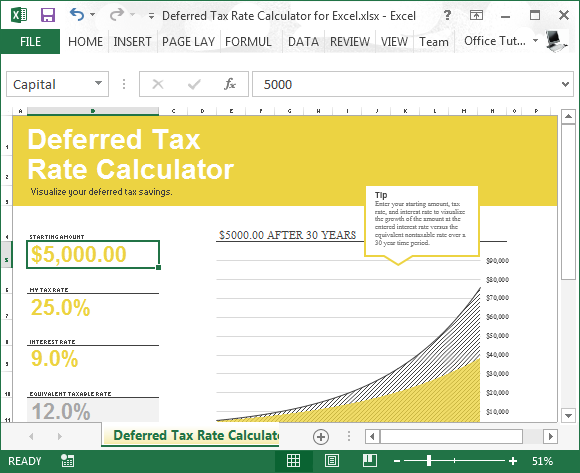

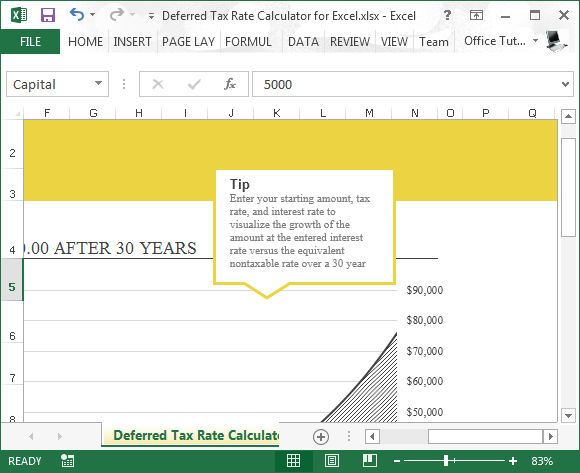

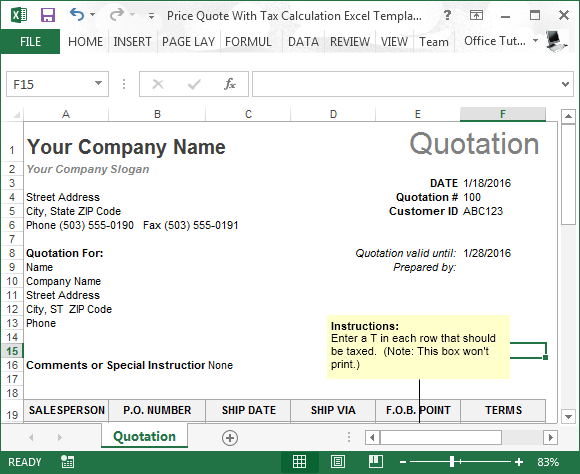

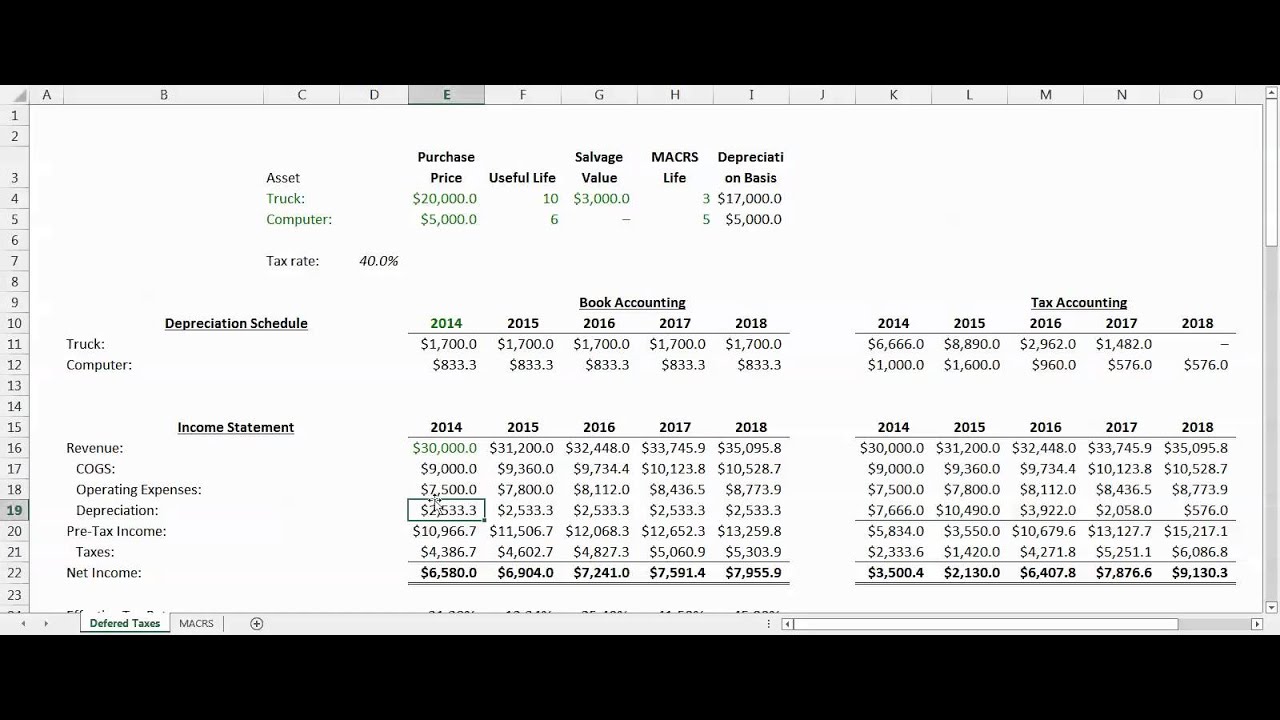

The business name that is entered in cell C5 is used as a heading on all the other sheets the year-end month that is selected in cell C7 is used in order to calculate year-to-date balances and the income tax percentage that is specified in cell C9 is used to calculate deferred tax balances. This template was designed to make getting this information as fast and convenient for you as possible All you need to do is follow the directions below to find out how much you could be saving by downloading the free Tax Rate Calculator today. Depreciation calculation sheet is created for Companies using WDV method and not for SLM method.

AS 22 Deferred Tax Calculator in EXCEL. Deferred Tax Liability arises due to timing difference in the value of Assets as per Books of Accounts and as per Income Tax Act. The only change was the interest earned on contribution of more than Rs 25 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate.

There was No major changes in income tax in Budget 2021. The Deferred Tax Rate Calculator makes finding both the equivalent taxable rate and equivalent non-taxable rate as simple as possible. Exporting Data in Excel.