Brilliant Equity, Balance Sheet Presentation Of Proprietorship

Owners equity in the balance sheets of sole proprietorship partnership and a limited company by completing the table in student worksheet p11.

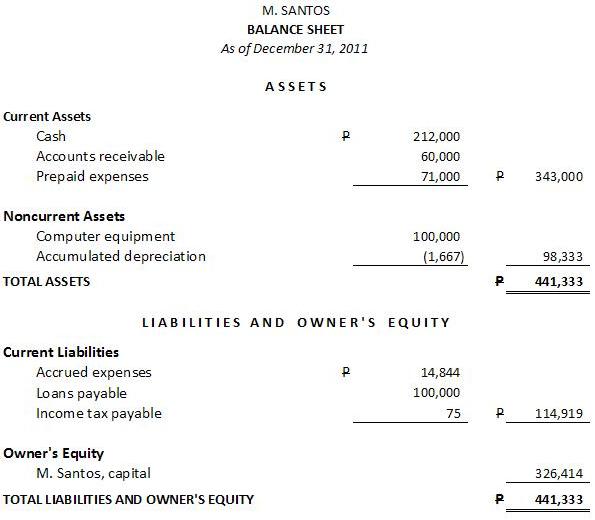

Equity, balance sheet presentation of proprietorship. Balance sheet should be prepared based on accepted accounting principles and standards. Balance Sheet Presentation A comparison of the capital section of the balance sheet for a sole pro-prietorship and for a corporation follows. Assets liabilities owner s equity.

Two other statements the statement of changes in owner s equity and the statement of cash flows are also often prepared. When intangible assets do have an identifiable value and lifespan they appear on a companys balance sheet as long-term assets valued according to their purchase prices and amortization schedules. Some companies state this fact.

Sole Proprietorship Corporation Owners Equity. Statement of Owners Equity summarizes changes in the owners capital account as a result of business transactions that occur during the period. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity.

How you record owners interest in the equity section of the balance sheet depends on the organization. Par value is the nominal value of the companys stock. Students are asked to explain different presentations shown in each type of business ownership.

Shareholders equity is the difference between total assets and total liabilities. The balance of the members equity is the amount left after crediting contributions distributing net profit or loss and debiting withdrawals if any. Its not as complex as it sounds.

Let us take a closer look at the Equity portion of that equation and how it is presented on the Balance Sheet and the Statement of Owners Equity. The owners equity section of a sole proprietorship owned by J. Br br financial statements of a sole trader the financial statements final accounts of a sole trader comprise.