Awesome Example Tax Basis Balance Sheet

For example for the balance sheet I would say in the title Balance Sheet for the Year Ended December 31 2018 and Consolidated Balance Sheet for the Year Ended December 31 2017 or I would just use the title Balance Sheet for the Years Ending December 31 2018 and December 31 2017 then I woould label the columns as 2018 and 2017 Consolidated.

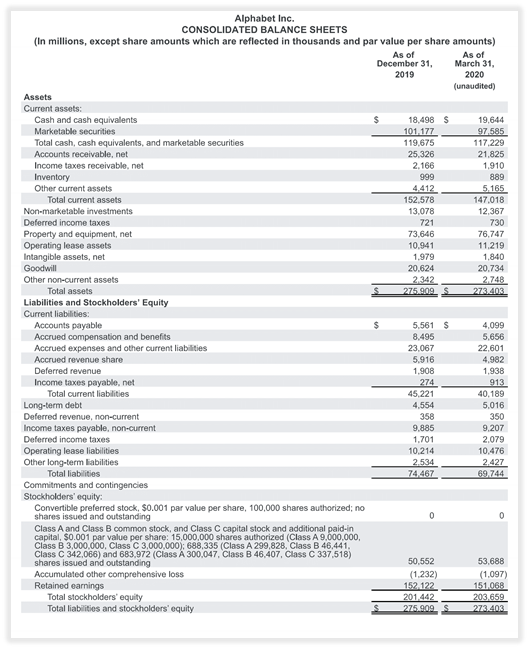

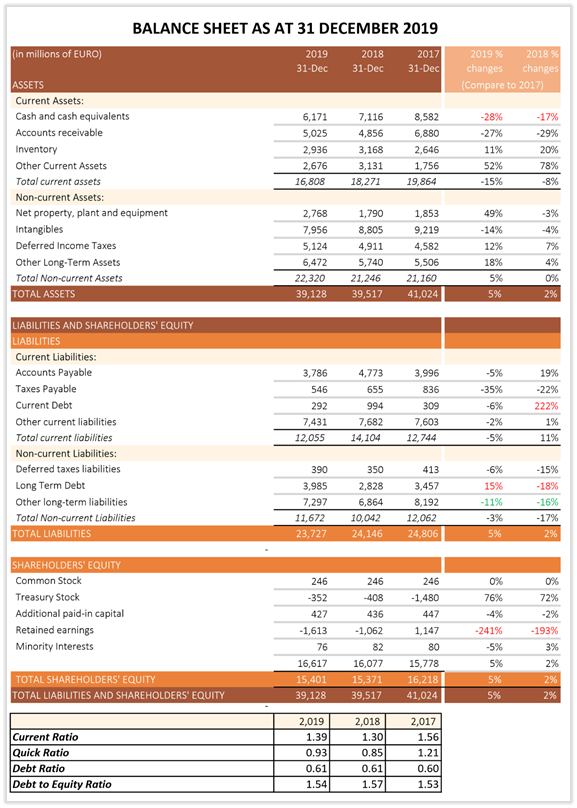

Example tax basis balance sheet. The first is dividends paid pre-tax dividends from the cash flow distribution that can bring the balance to below zero. Just as the financial statement balance sheet represents the book basis of assets and liabilities in accordance with GAAP the tax basis balance sheet represents the tax basis of assets and liabilities in accordance with tax rules and regulations by tax jurisdiction. A balance sheet is a financial statement that reports a companys assets liabilities and shareholders equity at a specific point in time and provides a basis for computing rates of return and.

This simple balance sheet template includes current assets fixed assets equity and current and long-term liabilities. Tax Basis Balance Sheet. Description of the Tax Basis Balance Sheet columns based on the provided configuration.

TBClosing Trial Balance Closing BalanceAutomatically populated with the. 15 16 Add lines 14 and 15. Used under the accrual basis.

If you dont override this amount the program will use the amount from Schedule M-2 line 3 to calculate the ending balance on Schedule L line 21. Fred deducted the entire 45000 loss on his 2013 Form 1040. A balance sheet is a snapshot at a specific point in time usually the end of a quarter or fiscal year that depicts the value of an entitys assets as they relate to its liabilities and equity.

Example 3 - Initial Basis. How to Prepare a Tax-Basis Balance Sheet. So the ending cash balance from last year will become the beginning cash balance this year.

If zero or less enter -0-. Therefore Fred claimed a 30000 loss in excess of his stock and debt basis. If the Schedule L balance sheet is kept on a bookGAAP basis youll need to override the ending partners capital accounts on Screen 24 Balance Sheet to enter the bookGAAP amount.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)