Recommendation Proposed Dividend Treatment In Cash Flow

Alternatively dividends paid may be classified as a component of cash flows from operating activities in order to assist users to determine the ability of an entity to pay dividends out of operating cash flows.

Proposed dividend treatment in cash flow. Financing business enterprises are the business enterprises which deal in finance like investment companies mutual fund house banks. Proposed dividend is one of the adjustments that is normally tested in every Cash Flow adjustment problem. Heres how the process works in a little more detail.

It is an outflow of cash and cash equivalent in the current year. This might include the final dividend from the previous financial period and an interim dividend issued during the period if any. Lets try to understand this through an example.

The above revised treatment in respect of proposed Dividend is inspired from para 12 and 13 of IAS 10 Ind. The proposed dividend of the previous year will be added back to Net profit under Operating Activities and the same amount Proposed dividend of the Previous year will be deducted under Financing Activities. Amount of dividend proposed for the previous year is shown as outflow of cash assuming that the shareholders have approved the proposed dividend as was recommended.

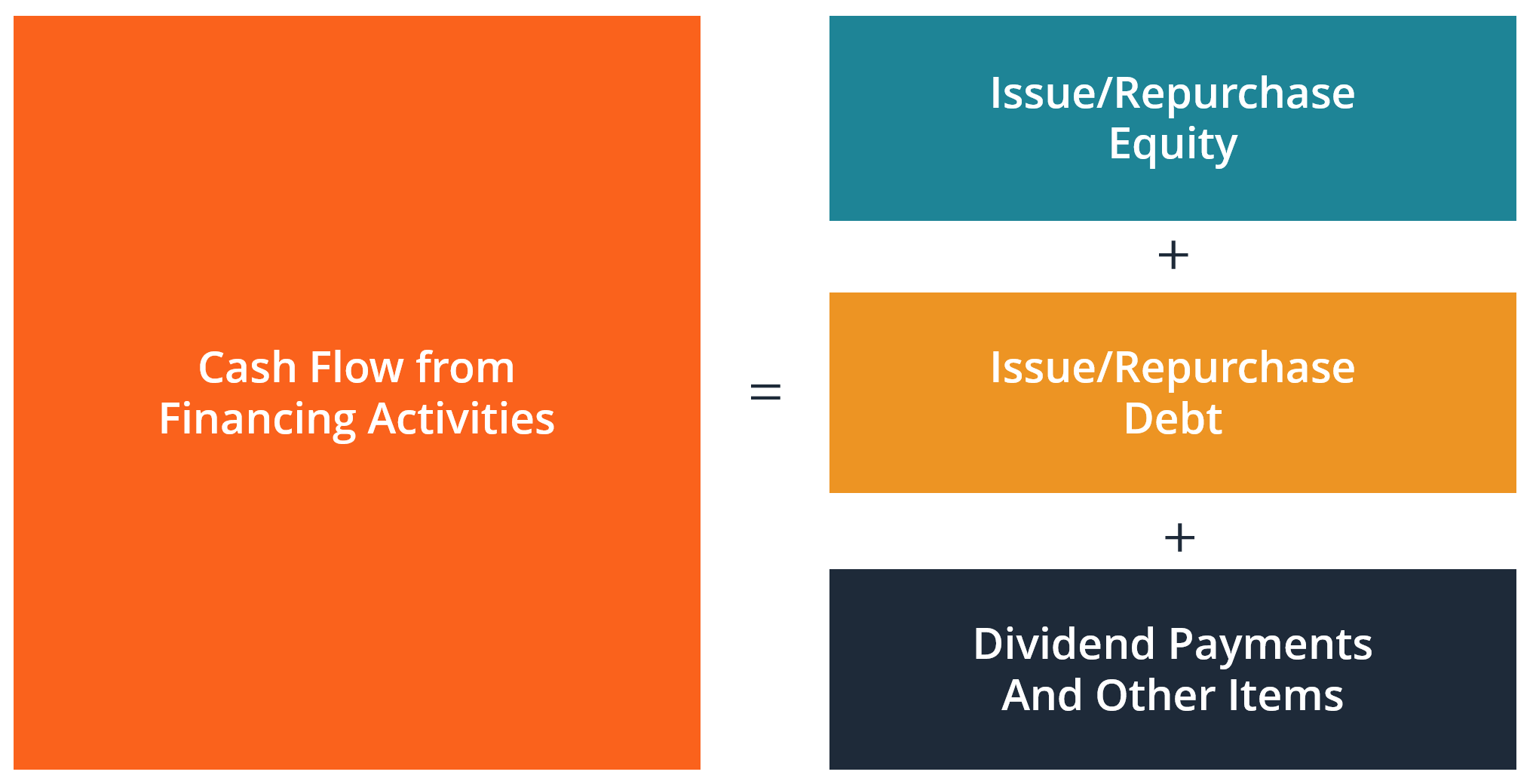

Make sure you only include dividends actually paid during the year in the statement of cash flows. Also it will be added to determine Net Profit Before Tax and Extraordinary Items under Cash Flow from Operating Activities. In simple words each shall be disclosed separately in Statement of Cash Flows.

Continuing with the earlier example if the company pays the cash dividends on June 15 the. A Proposed dividend may be treated as current liability. Financing Business Enterprise Transaction Treatment in Cash Flow statement.

Previous year proposed dividend- unpaid divided Final dividend paid during the current year is cash used in financing activities. Treatment of proposed dividend clearly mentioned in the AS 4. AS Events after the reporting period wherein it is specifically stipulated that such dividends do not meet the criteria of a present obligation as per IAS 37 Ind.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)