Beautiful Profitability Analysis Of Nabil Bank

For the fiscal year 207677 Nabil Bank has a distributable profit of Rs 304 Arba.

Profitability analysis of nabil bank. Nabil Bank Ltd. The 20-80 marketing principle says that 80 of the profits arrive from 20 of customers. Department of management for the degree of bachelor of business study.

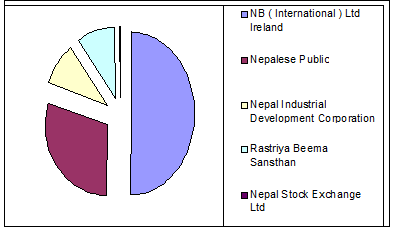

NABIL bank is distinguished for providing latest technology. Nabil commenced operation in Nepal on the 12th of July 1984 partnering with Dubai Bank Ltd through a Technical Service Agreement. Banks in the lowest quartile of ROA have a mean PB multiple of 119 while firms that belong to the highest quartile of ROA have a mean PB multiple of 25.

In the year 20062007 total deposit is. Objectives can be listed below. The bank made a profit of Rs.

To determine the magnitude of macroeconomic industry and bank specific variables on profitability of Nepalese commercial bank the following regression model is formulated. This is known as profitability analysis or customer profitability analysis CPA. Inadequate liquidity may lead to collapse of the bank while excess liquidity is determinant to banks profitability in order to remove demerits.

Karur vysya bank KVB South India bank SIB. Other objectives can be listed below. Based on the analyzed liquidity position the study will suggest the liquidity need and its management for the current year.

Nabil Bank generated a net interest income of Rs. The main objective of the study is to analyze the Nabil Banks liquidity position. But the ratio of NABIL is higher than that of NBL.