Divine Projected Balance Sheet For Mudra Loan

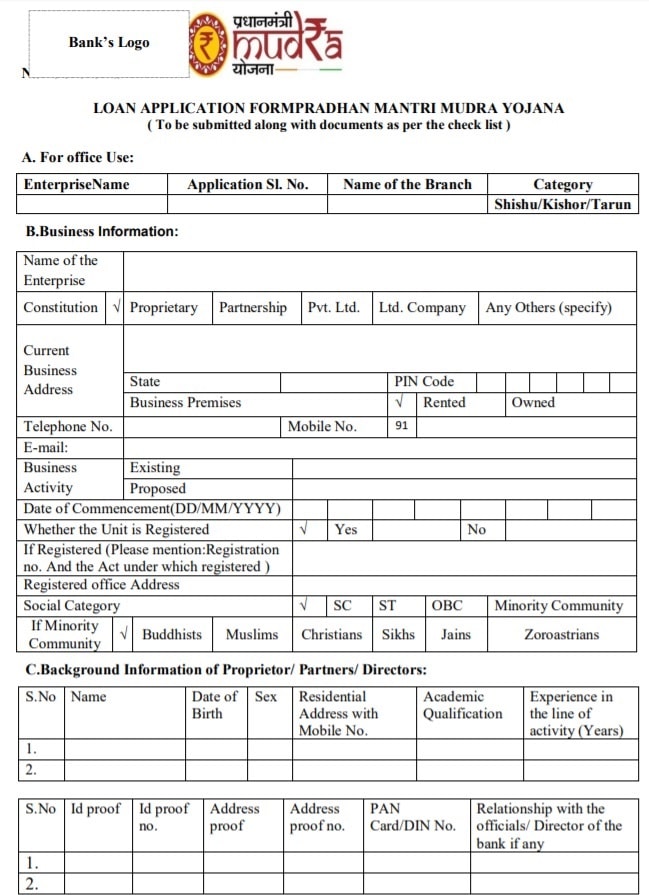

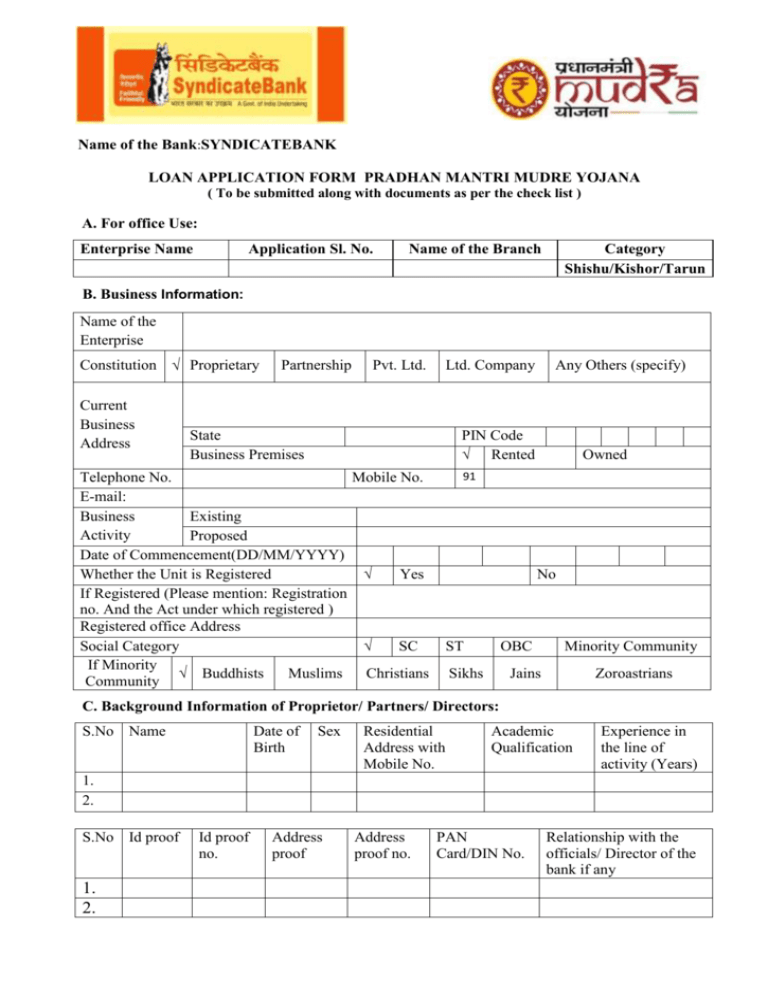

Mudra-loan-mudra-loan-eligibility Loan stands for Micro Units Development and Refinance Agency Limited and is a loan given to establish and.

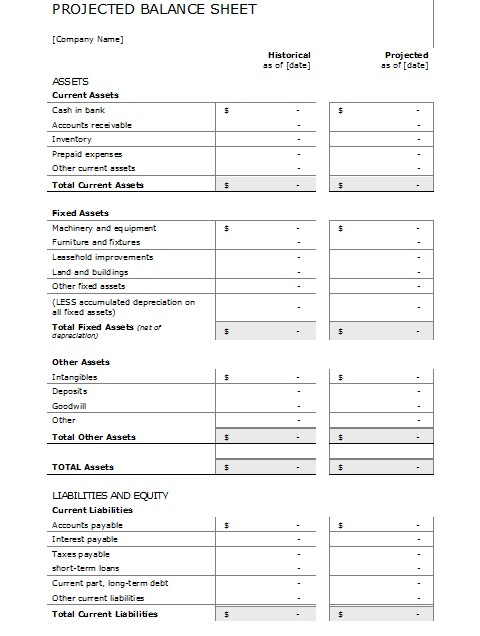

Projected balance sheet for mudra loan. Projected expenses balance sheet and business proposal for value or expansion. Ad Loan up to 90 of Your Credit Limit. The quick and dirty method of projecting balance sheet line items for current assets is to simply use a whole dollar value prediction for these accounts in.

Under this category the loan is sanctioned within the range of Rs 5 lakh to Rs 10 lakh. Cost of Project. Photocopies of lease deeds title deeds of the properties being offered as primary.

Who can make it. Balance sheet of previous two years. In case of a long-term loan the projected balance sheet must be provided for the loan tenure.

Cost of Project. Enjoy Exclusive Rates From 34 pa. You can use this format for taking mudra loan or availing cash credit cc or overdraft facility.

The task and process of creating an appropriate project report is very important as the details of the report are thoroughly checked by the financial institution of the bank that grants the loan. Projected Profitability Statement Form II Projected Balance Sheet Form III Comparative Operation Statement Form IV Maximum Permissible Bank Finance MPBF Form V Cash Flow Statement Form VI Monetary Projections Details Contains. Projected balance sheet for the next two years in case of working capital limits and of the period of the loan in case of term loan For all cases of Rs.

Introduction Description of the business. Ad Loan up to 90 of Your Credit Limit. Projecting balance sheet line items through the latter method is a bit more involved but will allow for more granularity and dynamism in the model.